A seismic shift in British politics has ushered in a new era, as the Labour Party secures a resounding victory in the 2024 General Election, promising transformative changes in governance and economic policy. Promises on employment and payroll were both part of Labour’s manifesto and actively promoted during the campaign.

As the new Prime Minister of the UK, Keir Starmer, leader of the Labour Party, pledged during his campaign to implement significant changes in employment and payroll. His key initiatives focus on job creation through a Green Prosperity Plan, improving workers’ rights, and establishing a living wage that reflects the cost of living. These promises aim to address economic stability, employment growth, and fair compensation.

Starmer’s win and Labour’s policies are expected to significantly impact employment and payroll in the UK. Here are some key aspects:

Employment and Job Creation

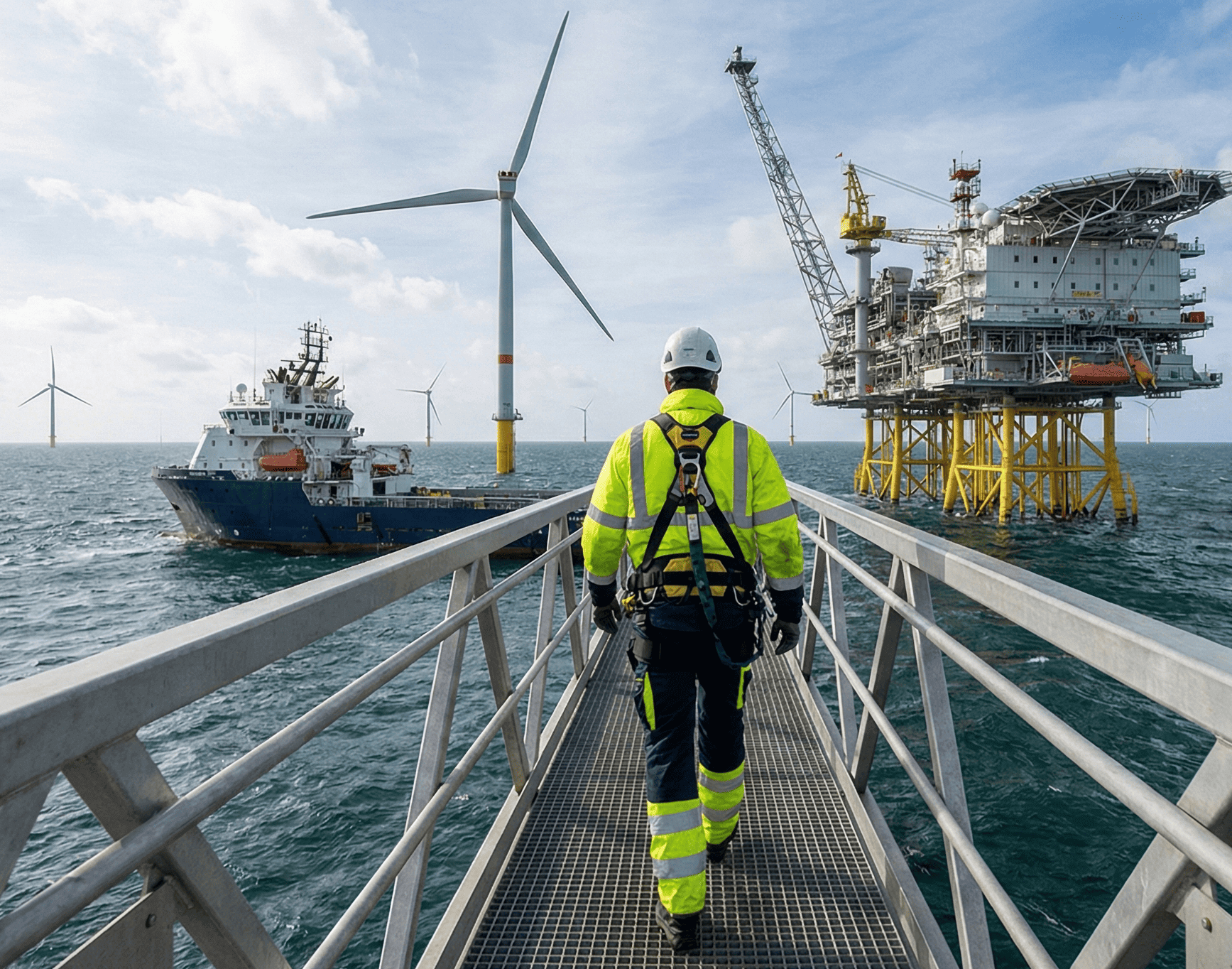

Labour outlined several initiatives aimed at boosting employment. They plan to create 650,000 jobs through their Green Prosperity Plan, which includes investments in clean energy and upgrading homes to improve energy efficiency. Additionally, Labour aims to support high-quality apprenticeships and establish new technical colleges to address skills shortages, particularly in tech and engineering.

Workers’ Rights and Conditions

The Party highlighted their commitment to improving workplace rights and conditions. This includes tackling issues such as late payments for the self-employed and reforming employment practices for gig economy workers. Labour plans to ensure all workers have the right to a written contract and timely payment, extend health and safety protections, and improve overall employment rights. They also propose legislation to improve working conditions within the first 100 days in office.

Payroll and Tax Policies

Labour has ruled out increasing income tax, capital gains tax, or corporation tax. However, they intend to close certain tax loopholes, such as the “non-dom”* (non-domiciled) tax status, and apply VAT and business rates to private schools. Abolishing the non-dom status could raise around £3.2 billion annually. Additionally, adding VAT and business rates to private schools is projected to generate an additional £1.8 billion per year. These measures could raise significant funds for public services without directly increasing the tax burden on ordinary workers.

Minimum Wage and Living Wage

Labour has pledged to make the minimum wage a genuine living wage that reflects the actual cost of living. This move aims to ensure that all workers receive fair compensation that keeps up with inflation and living expenses. According to a recent study, at least 3.7 million workers in the UK currently earn below a liveable wage, highlighting the critical need for this policy change.

Business and Economic Stability

Labour plans to introduce an “Office for Value for Money” and a fiscal lock to support economic stability and business confidence, ensuring that any permanent tax and spending changes are independently forecasted. This allows them to create a transparent and accountable system where economic decisions are thoroughly evaluated. This approach should encourage a stable economic environment conducive to business growth and employment, providing businesses with the confidence to invest and expand.

Overall, Starmer’s policies outlined in Labour’s manifesto aim to create jobs, improve workers’ rights, and ensure economic stability. These initiatives should have a positive impact on employment and payroll across the UK. The effectiveness of these policies will ultimately depend on their successful implementation and the commitment to follow through on these promises.

* = The “non-domiciled” or “non-dom” status is a tax designation in the UK that allows individuals who live in the UK but claim their permanent home (domicile) is abroad to avoid paying UK tax on foreign income, provided the income is not remitted to the UK.

Futurelink Group is dedicated to providing tailored solutions that maximise the benefits for both agencies and workers. Our customer-focused approach ensures that everyone can make the most out of their hard work and income. We prioritise compliance and efficiency, offering services that are not only reliable but also aligned with the latest regulations. With a commitment to excellence, we strive to support all our clients and workers in achieving their goals and enhancing their financial well-being.

For more information on our services or to receive a tailored solution for your workforce, get in touch with us at sales@futurelinkgroup.co.uk or 01923 277900.

All information and statistics in this article was gathered from the sources listed below:

- (Change – The Labour Party)

- (Yahoo)

- (Evening Standard)

- (LabourList)

- (The Independent)

- (LWF Report)

- (Full Fact Analysis)