Did you know that the UK offshore sector, particularly in renewables and the North Sea, is set to create thousands of contractor roles in 2026 to support net-zero goals and ongoing projects? Many UK professionals successfully transition into these high-earning positions by following structured steps, from obtaining essential certifications to selecting compliant payroll options that maximise take-home pay.

Key Areas We Will Cover

- Understanding offshore contractor roles in oil, gas, and renewables for 2026

- Essential certifications, medical requirements, and safety training

- Building experience, preparing applications, and finding your first contract

- Typical rotations, lifestyle realities, and practical preparation tips

- Tax residency under the Statutory Residence Test and potential reliefs like SED

- Payroll choices for UK contractors and compliance considerations

- How Futurelink Group supports offshore contractors with reliable solutions

Introduction

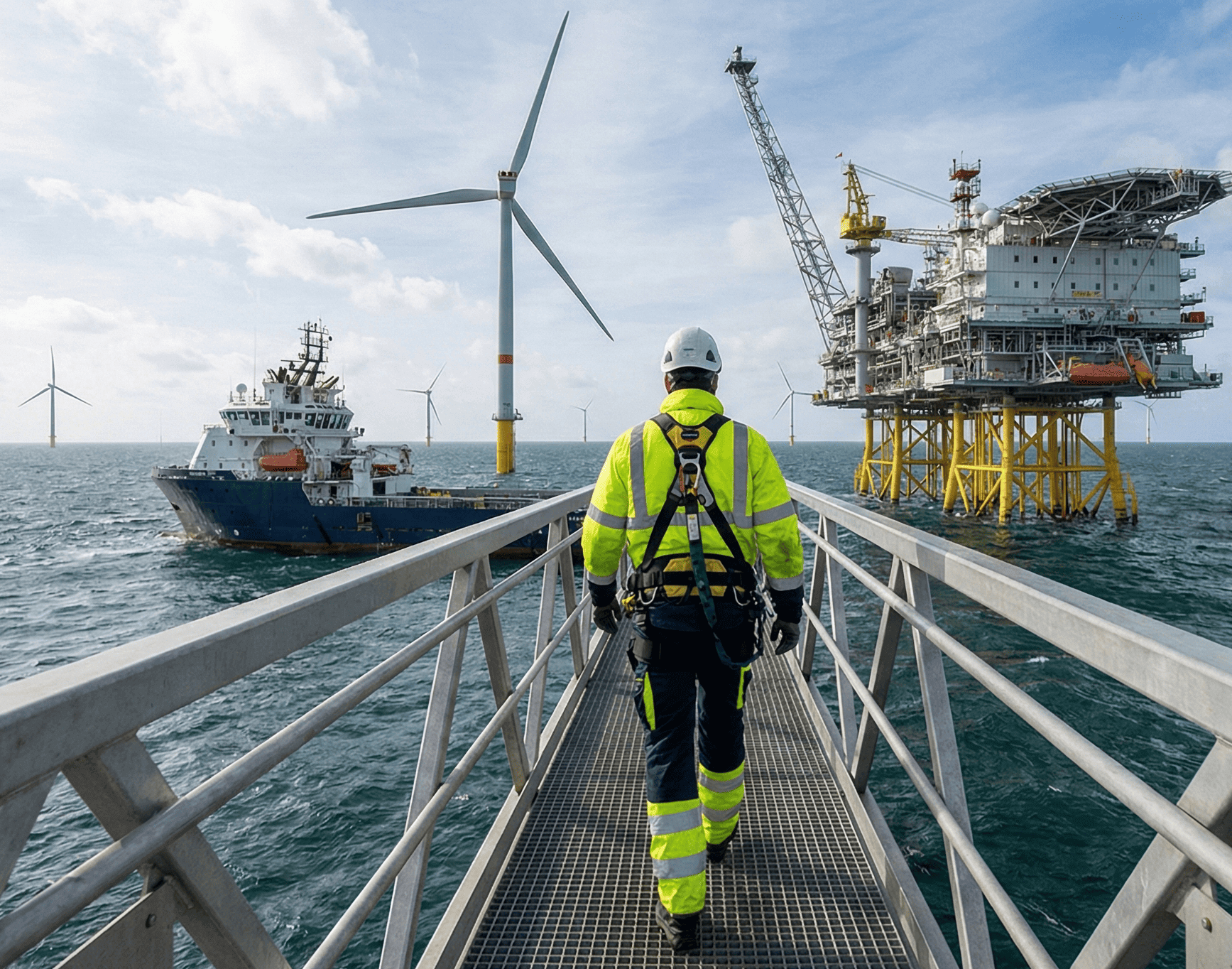

Starting work offshore as a UK contractor in 2026 presents strong opportunities in the North Sea oil and gas sector, as well as the booming offshore wind industry, driving the energy transition. With demand for skilled roles in engineering, maintenance, and specialised renewables work, contractors can access attractive day rates and rotational schedules. Success depends on gaining mandatory certifications like BOSIET, understanding tax rules via the Statutory Residence Test, and choosing compliant payroll to handle PAYE accurately. This step-by-step guide walks you through the process, highlighting key requirements and how partnering with experts like Futurelink Group ensures smooth payments and compliance.

Step 1: Research Roles and Assess Suitability

Offshore contracting includes positions on oil platforms, gas installations, and wind farms, covering disciplines such as electrical, mechanical, turbine technicians, and entry-level support roles.

- Rotations often follow 2 weeks on and 2 weeks off patterns, with 12-hour shifts and helicopter or vessel transfers.

- Benefits include higher earnings, extended leave, and potential tax advantages.

- Challenges involve isolation, physical demands, and time away from family. Evaluate your skills, fitness, and personal circumstances, consider starting with onshore experience if new to the field, and explore renewables for growing entry points.

Step 2: Complete Mandatory Certifications and Medical Checks

Safety qualifications are required by most operators in UK waters and internationally.

- BOSIET (Basic Offshore Safety Induction and Emergency Training): A 3-day OPITO-approved course covering survival, firefighting, helicopter escape, and emergency breathing systems (often with CA-EBS), valid for 4 years.

- MIST (Minimum Industry Safety Training): Essential for UK North Sea operations, providing basic safety knowledge.

- OGUK (Offshore Energy UK) Medical: A fitness certificate from an approved doctor confirming suitability for offshore work.

- For offshore wind: Additional GWO certifications like Working at Heights or First Aid may apply. Enrol with accredited providers early, as these are prerequisites for applications and typically cost several hundred pounds.

Step 3: Build Relevant Experience and Prepare Your Application

Entry-level roles like roustabout or trainee technician exist, though transferable skills from construction, engineering, or onshore energy help.

- Update your CV to emphasise safety awareness, technical abilities, and reliability.

- Network via LinkedIn, join industry groups, and register with specialist recruitment agencies focused on energy.

- Apply through job boards, direct operator postings, or agencies, highlighting certifications and right to work in the UK.

Step 4: Secure a Contract and Understand Rotations

Agencies often facilitate placements; expect safety-focused interviews and short-notice starts.

- Common rotations include 14 days on and 14 days off, with employer-arranged travel.

- Track offshore days via systems like Vantage or MAPS to comply with work limits.

- Day rates vary by role and experience, often higher in renewables transition projects.

Step 5: Navigate Tax Residency and Payroll Options

Offshore work in UK-designated areas generally counts as UK duties for tax purposes.

- Statutory Residence Test (SRT): Determines residency based on days spent in the UK, ties (family, accommodation), and work patterns; fewer than 91 days in the UK with full-time overseas work can lead to non-residency.

- Seafarers’ Earnings Deduction (SED): Offers 100% relief on qualifying foreign earnings if conditions are met (e.g., duties outside the UK, 365+ days qualifying period).

- Payroll choices: The most popular and tax-efficient option for contract workers is to be paid as a Sole Trader and manage tax affairs through an annual tax return. This can mitigate tax and National Insurance (Social Security) using tax-deductable expenses.

Where status is determined by the end-client and a requirement for the contractor to be employed, utilising an Umbrella PAYE solution is straightforward and puts the onus on the umbrella or hiring company to manage taxes upfront. Where the hiring company prefers to cover employment costs, a PEO (Professional Employer Organisation) can be ideal for the worker. You can find a provider to manage deductions accurately and avoid penalties, especially with the 2026 umbrella reforms increasing scrutiny. Companies like Futurelink Group meet all the necessary obligations by supporting both the worker and hiring company. They can help determine a suitable payroll solution to meet the needs of the client and expectations of the worker, whilst assuring full compliance.

Step 6: Prepare Practically for Offshore Life

- Pack PPE (often supplied), personal essentials, medications, and communication devices.

- Plan family support and emergency contacts.

- Maintain physical fitness and mental resilience for demanding conditions. Allow 3 to 6 months for certifications, applications, and setup.

Conclusion

Becoming an offshore contractor in 2026 involves securing certifications like BOSIET and medical clearance, targeting roles in high-demand sectors, and carefully managing tax residency under the Statutory Residence Test alongside compliant payroll. With thorough preparation, you can access rewarding opportunities in oil, gas, and renewables while maximising earnings and minimising risks. Focus on safety, compliance, and reliable support to build a sustainable career.

Get Started Today

Ready to begin your offshore contracting journey in 2026?

Contact Futurelink Group for personalised advice on compliant self-employed and employed solutions, and offshore payroll tailored for UK contractors.

Call us on +44 (0) 1923 277900 or email sales@futurelinkgroup.co.uk, based at Kings House, Home Park Estate, Station Road, Kings Langley, WD4 8LZ.

Frequently Asked Questions About Starting Offshore Work as a UK Contractor in 2026

These address common queries from beginners, drawing on current industry and HMRC guidelines.

BOSIET (with CA-EBS), MIST for North Sea, and an OGUK medical are mandatory; offshore wind may require GWO training.

Most follow 2 weeks on and 2 weeks off (14/14), with 12-hour shifts and employer-provided travel.

Use the Statutory Residence Test for residency; work in UK sector areas counts as UK duties, but SED may provide relief for qualifying seafarers.

Yes, entry-level roles exist; complete BOSIET and build transferable skills, with strong demand in renewables.

We offer compliant payroll options, accurate deductions, support for potential SED claims, same-day payments, and full insurance for peace of mind.

Craig Moss

Craig Moss is a seasoned professional in the employment and recruitment industries, based in Kings Langley, UK. With over 30 years of experience, including a successful tenure as a central London realtor handling properties up to £3 million, he now leads an exciting management role at Futurelink Group. Specialising in compliant payroll solutions for contract recruitment, Craig helps clients increase margins by up to 30% while navigating complex legislation. His people-focused approach, honed through decades in sales and people management, ensures both recruiters and workers benefit from tax-efficient, compliant solutions. Passionate about building strong relationships, Craig thrives on delivering results that drive business success.