Did you know that in 2026, millions of contractors worldwide are embracing international opportunities, drawn by higher pay rates, digital nomad lifestyles, and booming sectors like tech, renewables, and engineering?

Yet many overlook critical steps such as tax residency rules and visa requirements, leading to unexpected liabilities or missed savings. Starting with a clear plan can turn this into a rewarding move.

Key Areas We Will Cover

- Popular destinations for contractors in 2026 and why they appeal

- Assessing tax residency and obligations in your home and host countries

- Visa, work permit, and legal entry requirements worldwide

- Choosing compliant payroll and payment structures for international work

- Handling double taxation, contracts, and potential reliefs

- Practical preparation steps, including banking, insurance, and lifestyle setup

- How Futurelink Group supports contractors with global-friendly solutions

Introduction

Working abroad as a contractor in 2026 offers freedom, diverse projects, and often better earnings across industries like IT, construction, energy, and creative fields. From remote tech gigs in Europe to on-site engineering roles in the Middle East or Asia, contractors can thrive in a global market. Success hinges on understanding tax residency rules, securing proper visas, selecting reliable payroll options, and managing cross-border compliance. This guide provides a straightforward starting point for contractors anywhere in the world, helping you navigate essentials and avoid common pitfalls while maximising opportunities.

Why Contractors Choose to Work Abroad in 2026

Contractors pursue international work for varied reasons, including higher day rates, lifestyle perks, and access to exciting projects.

- Tech and digital roles thrive in Europe (e.g., Portugal, Spain) with digital nomad visas and strong infrastructure.

- Engineering and renewables attract professionals to the Middle East (e.g., UAE for tax advantages) or Asia-Pacific.

- Affordable living and vibrant expat communities draw many to Latin America or Southeast Asia.

- Benefits include cultural experiences and networking, but planning for tax, legal, and practical aspects is key to sustainability.

Step 1: Evaluate Your Tax Residency and Obligations

Tax residency determines where you pay taxes on worldwide income, often based on days spent in a country or ties like home and family.

- Many countries use a 183-day rule for residency; exceeding this can trigger local tax on global earnings. Workers on equal rotation can avoid this issue.

- Home country rules (e.g., citizenship-based taxation in some nations) may still apply even abroad.

- Double taxation agreements between countries prevent paying twice, often via credits or exemptions. Track days meticulously and review changes in 2026, such as updated non-residence rules in certain jurisdictions, to stay compliant.

Step 2: Research Visas and Work Permissions

Visa needs depend on your nationality, destination, and contract duration.

- Digital nomad visas in countries like Portugal, Spain, or Thailand suit remote contractors for stays up to 1-2 years.

- Skilled worker or business visas apply for project-based roles in places like Canada, Australia, or the UAE.

- Short-term assignments may fall under visitor rules, but longer work requires proper authorisation to avoid fines. Check official immigration sites early, as processing times vary, and consider professional advice for complex cases.

Step 3: Select Suitable Payroll and Payment Options

International contracting demands flexible structures for secure, compliant payments.

- Independent contractors can enjoy self-employed options, paid either as a sole trader or via a Personal Service Company.

- Umbrella or similar employment style services provide simplicity for short-term or UK-linked work.

- Independent contractor setups (e.g., via local registration) offer control but require more administration.

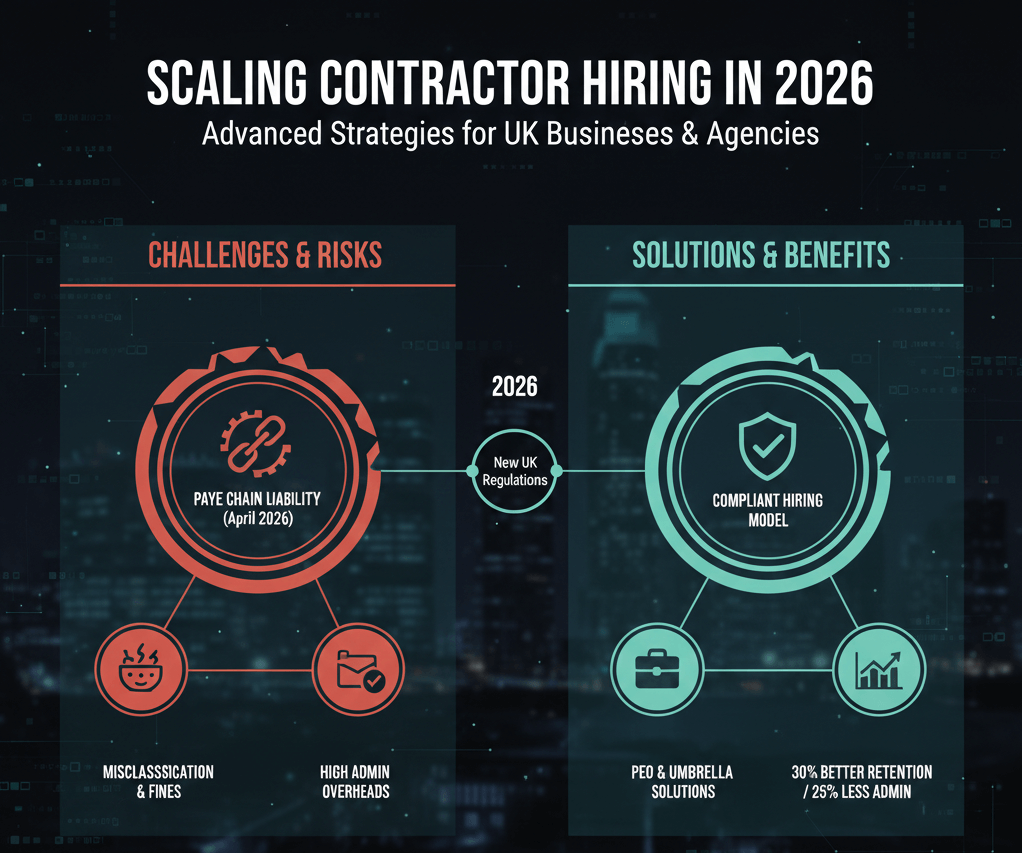

- PEO or co-employment solutions handle multi-country compliance, benefits, and deductions without needing local entities. Opt for providers with international experience to manage currency conversions, timely payments, and reporting accurately.

Step 4: Manage Tax, Contracts, and Double Taxation

Prepare for obligations in both home and host countries.

- Draft clear contracts outlining scope, payment terms, IP rights, and termination to protect all parties.

- Use double taxation treaties for relief; claim credits where income is taxed twice.

- File required returns (e.g., self-assessment equivalents) and retain records of income, days worked, and expenses. Consult local tax rules, as some countries offer incentives for foreign contractors while others impose strict withholding.

Step 5: Handle Practical and Lifestyle Preparation

- Arrange international banking for efficient transfers and local access.

- Secure suitable health, professional indemnity, and travel insurance.

- Research cost of living, housing, and expat communities in your target location.

- Plan for family needs, time zones, and reliable internet to maintain productivity.

Conclusion

Working abroad as a contractor in 2026 can deliver financial rewards, professional growth, and enriching experiences when approached thoughtfully. Begin by clarifying tax residency, securing appropriate visas, choosing compliant payroll, and preparing practically to navigate global complexities smoothly. With solid planning and reliable support, you can focus on delivering exceptional work in new markets while protecting your earnings and peace of mind.

Get Started Today

Planning to work abroad as a contractor in 2026? Contact Futurelink Group for expert guidance on compliant payroll solutions, including umbrella PAYE and PEO options designed for international scenarios. Call us on +44 (0) 1923 277900 or email sales@futurelinkgroup.co.uk based at Kings House, Home Park Estate, Station Road, Kings Langley, WD4 8LZ.

Frequently Asked Questions About Working Abroad as a Contractor in 2026

These address frequent concerns for contractors going international, based on current global guidelines and trends.

Use rules like the 183-day threshold or ties test in your home and host countries; double taxation agreements often provide relief to avoid double payments.

Digital nomad visas in Portugal, Spain, or Thailand offer flexibility for remote work; skilled or business visas suit project-based roles in other destinations.

Umbrella services simplify compliance for shorter assignments; PEO options provide broader support and benefits for longer or multi-country work.

Treaties between most countries prevent this through credits or exemptions; track income sources and consult rules for your specific locations.

We deliver compliant payroll tailored to cross-border needs, handle deductions accurately, offer same-day payments, and provide support for secure global operations.

Craig Moss

Craig Moss is a seasoned professional in the employment and recruitment industries, based in Kings Langley, UK. With over 30 years of experience, including a successful tenure as a central London realtor handling properties up to £3 million, he now leads an exciting management role at Futurelink Group. Specialising in compliant payroll solutions for contract recruitment, Craig helps clients increase margins by up to 30% while navigating complex legislation. His people-focused approach, honed through decades in sales and people management, ensures both recruiters and workers benefit from tax-efficient, compliant solutions. Passionate about building strong relationships, Craig thrives on delivering results that drive business success.