Did you know that over 600,000 UK contractors now use umbrella companies to simplify their payroll and stay compliant with HMRC regulations? With the gig economy booming and IR35 reforms shaping how contractors operate, understanding umbrella companies is more crucial than ever for freelancers and self-employed professionals. Umbrella Payroll companies seek to offer hassle-free solutions, combining compliance, flexibility, and practical tools like mobile apps for expense tracking.

Key Areas We Will Cover

- What an umbrella company is and how it works

- Benefits and drawbacks for contractors in 2025

- How umbrella companies align with IR35 and tax compliance

- Choosing the right umbrella company for your needs

- Common myths and FAQs about umbrella companies

- Why Futurelink Group stands out with tailored solutions and innovative tools

Introduction

An umbrella company acts as an intermediary between contractors and their clients, managing payroll, taxes, and compliance while offering the flexibility of self-employment. In 2025, with the UK’s freelance workforce growing and HMRC tightening IR35 regulations, umbrella companies have become a popular choice for contractors seeking simplicity, security, and efficiency. This guide explains what an umbrella company is, its benefits and drawbacks, and how to choose a reputable provider like Futurelink Group, which offers 27 years of expertise and practical tools such as an expenses app and multilingual support.

What Is an Umbrella Company?

An umbrella company is a third-party employer that manages payroll, taxes, and administrative tasks for contractors. By becoming an employee of the umbrella company, contractors can focus on their work while the company handles invoicing, tax calculations, and compliance with UK tax laws, including National Insurance contributions.

How Does an Umbrella Company Work?

- Contractor Agreement: You sign up with an umbrella company, such as Futurelink Group, and work under their employment structure. Futurelink’s streamlined onboarding process takes under 20 minutes.

- Invoicing: The umbrella company invoices your client or agency for your work based on submitted timesheets.

- Payroll Processing: The company deducts PAYE taxes, National Insurance, and a service fee (typically £20–£30 per week), then pays you a net salary. Futurelink Group runs payroll daily—twice on Fridays—for prompt payments.

- Compliance: The umbrella company ensures adherence to HMRC regulations, including IR35 rules, reducing compliance risks.

- Benefits: You gain access to employee benefits like holiday pay, sick pay, pension contributions, and insurance coverage.

This structure is ideal for contractors who want to focus on their work without the administrative burden of running a limited company.

Benefits of Using an Umbrella Company in 2025

Umbrella companies offer several advantages, particularly in the context of recent UK legislative changes:

- Simplified Administration: No need to manage payroll, VAT, or tax returns. Futurelink Group’s online portal provides 24-hour access to timesheets and payslips, while their expenses app (available on Google Play and iOS App Store) simplifies expense claims.

- IR35 Compliance: Umbrella companies handle IR35 assessments, ensuring compliance with HMRC regulations and reducing the risk of penalties.

- Employee Benefits: Access statutory benefits like holiday pay, sick pay, maternity/paternity leave, and pension schemes, providing financial security.

- Flexibility: Work on multiple contracts without setting up a limited company, maintaining a single employment relationship with the umbrella company.

- Quick Setup and Payments: Start working immediately with fast onboarding. Futurelink Group ensures reliable, transparent payments with daily payroll runs.

- Multilingual Support: Futurelink Group supports contractors whose first language is Romanian, Italian, Spanish, Polish, or English, breaking language barriers for multinational workforces.

Drawbacks to Consider

- Fees: Umbrella companies traditionally charge a weekly fee, reducing take-home pay. However, Futurelink Group offers competitive margins to maximise contractors’ net income.

- Less Control: You have less control over tax planning compared to a limited company or sole trader status.

- Dependency: Your income relies on the umbrella company’s efficiency. Futurelink Group mitigates this with prompt payments and a robust online portal.

Umbrella Companies and IR35 in 2025

The IR35 reforms, fully implemented in the private sector by 2021, continue to impact contractors in 2025. Umbrella companies play a critical role in ensuring compliance:

- IR35 Assessments: Reputable providers like Futurelink Group conduct status determination statements (SDS) to confirm your employment status.

- PAYE Compliance: By processing income through PAYE, umbrella companies ensure HMRC compliance.

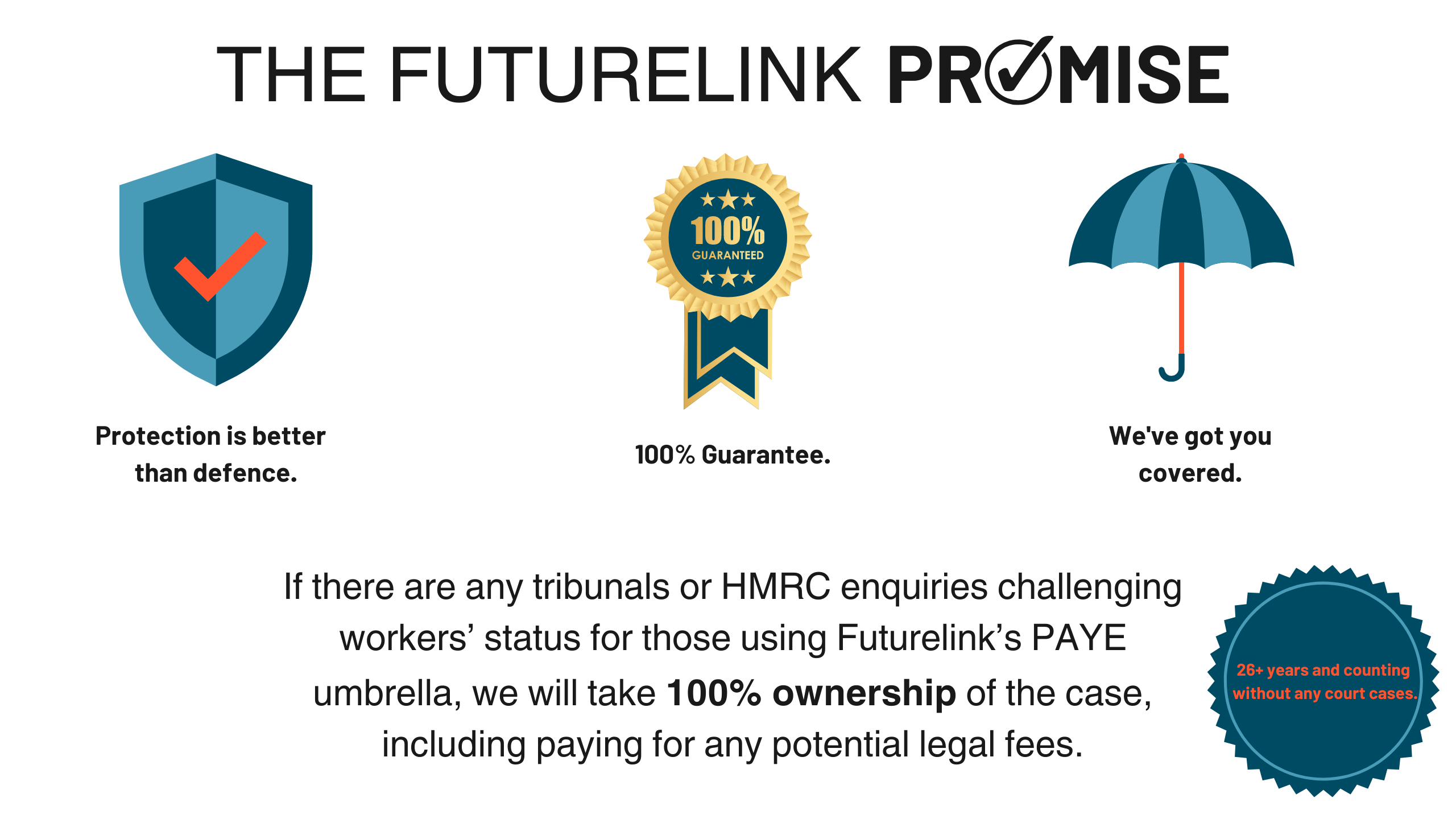

- Risk Mitigation: Working through a compliant umbrella company reduces the risk of HMRC investigations.

“Since the IR35 reforms, umbrella companies have become a lifeline for contractors navigating complex tax rules,” says Jane Smith, a tax consultant.

How to Choose the Right Umbrella Company

With hundreds of umbrella companies in the UK, selecting a reputable provider is crucial. Here’s what to look for in 2025:

- Accreditation: Choose a company accredited by the Institute of Chartered Accountants in England and Wales (ICAEW) or other established auditors. Futurelink Group proudly has ICAEW-accreditation.

- Transparency: Ensure clear fee structures with no hidden costs. Futurelink Group offers competitive margins to maximise take-home pay.

- Support Services: Look for dedicated account managers and responsive customer support, including multilingual assistance for diverse workforces.

- Compliance Record: Verify the company’s history of HMRC compliance.

- Reviews and Reputation: Check contractor forums and platforms like Trustpilot for feedback.

- Innovative Tools: Futurelink Group provides a mobile expenses app and an online portal for seamless payroll management.

Red Flags to Avoid

- Promises of higher take-home pay through non-compliant schemes.

- Lack of accreditation or unclear terms and conditions.

- Poor communication or delayed payments.

Common Myths About Umbrella Companies

- Myth: Umbrella companies are only for low-earning contractors.

Reality: They suit contractors at all income levels seeking simplicity and compliance. - Myth: Umbrella companies avoid taxes.

Reality: Reputable providers like Futurelink Group ensure full HMRC compliance. - Myth: You lose all control over your finances.

Reality: While they handle payroll, you manage your contracts and work.

Frequently Asked Questions About Umbrella Companies

Below are answers to common queries to help you understand whether an umbrella company is right for you:

No, but an umbrella company like Futurelink Group is a simpler alternative if you prefer not to manage your own company.

No, fees are deducted from your gross pay before tax calculations. All fees are tax-deductible which means they will reduce the amount of tax you pay.

Yes, you can switch at any time, following contract terms.

Reputable providers process allowable expenses per HMRC guidelines. Futurelink Group’s expenses app simplifies claims.

Reliable providers like Futurelink Group have processes to chase payments; confirm their policy before signing up.

Yes, they’re ideal for short-term or multiple contracts, offering flexibility without a permanent business structure.

Why Choose Futurelink Group?

With 27 years of experience, Futurelink Group offers tailored payroll solutions for contractors, agencies, and clients. Their expertise ensures accurate, compliant payroll management, while competitive margins maximise your take-home pay. Key features include:

- Fast Onboarding: Register in under 15 minutes.

- Daily Payroll: Prompt, transparent payments, with twice-daily runs on Fridays.

- Multilingual Support: Fluent customer service in Romanian, Polish, Italian, Spanish, and English.

- Digital Tools: A mobile expenses app and 24/7 online portal for timesheets and payslips.

Conclusion

In 2025, umbrella companies will remain a vital solution for UK contractors navigating IR35, tax compliance, and payroll management. By outsourcing administrative tasks, contractors can focus on their work while enjoying employee benefits and peace of mind. Choosing a reputable, ICAEW-accredited provider like Futurelink Group ensures compliance, reliability, and access to innovative tools like their expenses app and multilingual support.

Take Control of Your Contracting Career

Ready to simplify your freelance journey? Contact Futurelink Group today to explore our ICAEW-accredited umbrella company services.

Visit our website at www.futurelinkgroup.co.uk, call 01923277900, or email sales@futurelinkgroup.co.uk for a free consultation