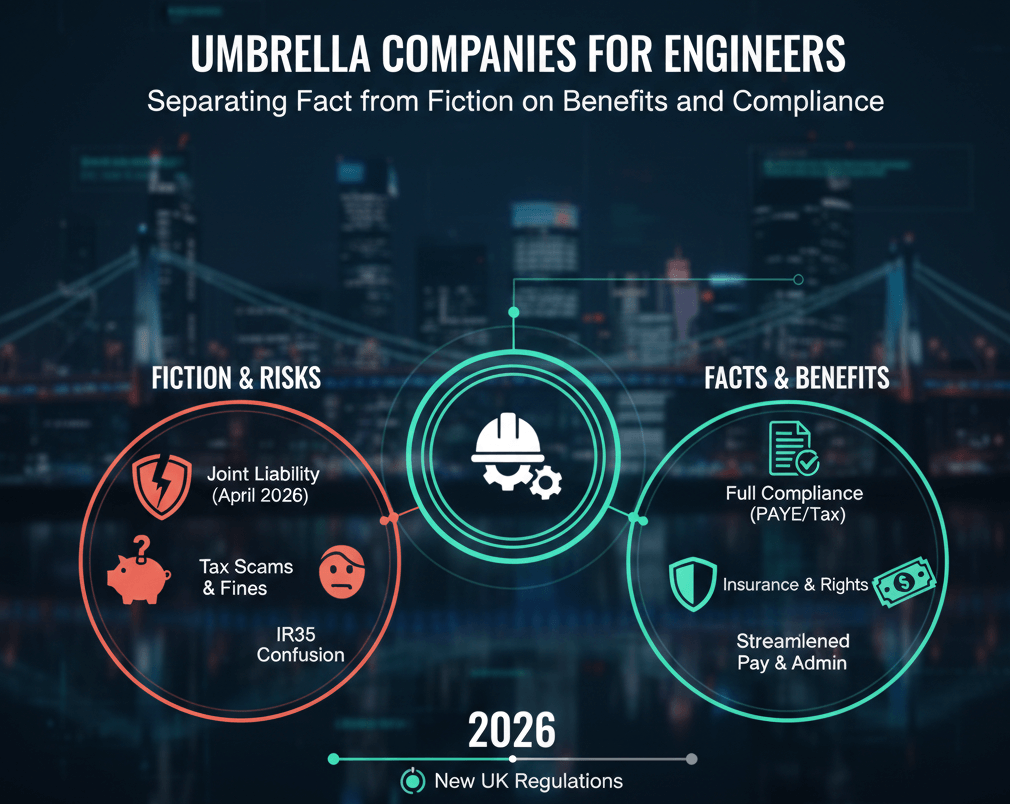

Did you know that from April 2026, new UK rules introduce Joint and Several Liability for agencies and end clients in umbrella supply chains, making the choice of a fully compliant umbrella provider more critical than ever for engineers facing potential tax recovery risks? This change dispels myths about umbrella safety while highlighting genuine advantages for compliant operators.

Key Areas We Will Cover

- Common myths surrounding umbrella companies for engineers

- Real benefits of using umbrella solutions in engineering roles

- IR35 compliance facts post-reforms and 2026 changes

- How umbrella companies support engineers in practice

- Choosing a compliant provider and avoiding pitfalls

Introduction

Umbrella companies for engineers provide a straightforward PAYE payroll solution that simplifies tax, National Insurance, and compliance for contract work in sectors like energy, manufacturing, and civil engineering. Amid IR35 post-reform clarity and the upcoming April 2026 joint and several liability rules, understanding the facts versus fiction helps engineers make informed decisions. This guide debunks prevalent myths, outlines genuine benefits, and explains compliance realities, showing how reliable providers like Futurelink Group deliver secure, efficient support for engineering contractors.

Debunking Common Myths About Umbrella Companies for Engineers

Several misconceptions persist about umbrella arrangements, often fuelled by outdated information or non-compliant operators.

- Myth: Umbrella companies only exist because of IR35 reforms. Umbrella companies predate IR35 changes, offering a stable PAYE framework for contractors with multiple short-term assignments long before 2017 or 2021 off-payroll rules.

- Myth: All umbrella companies are the same and equally risky. Compliant umbrellas operate under strict HMRC rules with transparent deductions, while non-compliant ones have damaged reputations; 2026 joint and several liability now holds agencies and clients accountable for failures in the chain.

- Myth: Engineers lose significant take-home pay through umbrella fees. Transparent weekly or margin fees cover payroll, compliance, and benefits; compliant structures ensure deductions match HMRC standards, often comparable to other PAYE options when factoring in saved administration.

- Myth: Umbrella employment means no IR35 concerns. True for genuine umbrella setups, as engineers become employees of the umbrella company, removing IR35 determination risks entirely.

- Myth: Umbrellas offer no real benefits beyond basic payroll. Many provide statutory entitlements, insurances, and support that rival or exceed self-managed options.

- Myth: Self-employed status will not exist from April 2026. Not true because the new legislation has been brought about to stop non-compliance – umbrellas that offer some form of disguised remuneration or tax planning. Self-employment will be accepted – determined by the hiring company/end-client.

Separating these myths from facts reveals umbrellas as a reliable choice for many engineers.

Genuine Benefits of Umbrella Companies for Engineers

For engineers on contract roles, often inside IR35 due to client control or project nature, umbrellas deliver practical advantages.

- Simplified Compliance and Zero IR35 Risk: As an employee of the umbrella, PAYE handles tax and NI automatically; no need for personal IR35 assessments or CEST tool usage.

- Access to Statutory and Enhanced Benefits: Eligibility for SSP, SMP, holiday pay (accrued at 12.07%), and automatic pension enrolment (e.g., NEST after qualifying periods) provides security often absent in limited company setups.

- Comprehensive Insurances Included: Many umbrellas cover public liability, employers’ liability, personal accident, and professional indemnity, essential for site-based or high-risk engineering work.

- Faster Payments and Reduced Admin: Daily payroll runs, same-day processing upon fund receipt, and online portals streamline cash flow and expense claims.

- Focus on Engineering Expertise: Outsource payroll complexities to concentrate on technical delivery, project deadlines, and skill development in demanding fields.

These benefits support professional stability in competitive engineering markets.

IR35 Compliance Facts Post-Reforms and 2026 Updates

The 2024 IR35 offsets reform reduced hirer liabilities by deducting prior taxes paid, encouraging more flexible engagements while reinforcing umbrella as a low-risk default for inside IR35 contracts.

From April 2026, joint and several liability shifts PAYE responsibility up the supply chain, meaning agencies or end clients face recovery for unpaid taxes if an umbrella fails to remit. This change drives demand for accredited, compliant providers with strong track records.

Engineers benefit from umbrellas’ inherent compliance, avoiding personal liability while aligning with HMRC expectations.

How Umbrella Companies Support Engineers in Practice

In engineering, where contracts often involve site work, technical oversight, or project delivery under client direction, umbrellas fit seamlessly.

Compliant providers handle RTI submissions, expense processing (travel, accommodation, training), and sector-specific needs like CIS integration for construction-related engineering. Engineers gain peace of mind through dedicated support, clear payslips, and protections that enhance employability.

Conclusion

Umbrella companies for engineers offer clear benefits in compliance, benefits access, and administrative relief, particularly valuable post-IR35 reforms and with 2026 joint and several liability rules heightening scrutiny. By focusing on accredited providers, engineers separate fact from fiction to secure reliable, low-risk arrangements that support career focus and financial stability.

Get Started Today

Ready to explore umbrella solutions tailored for engineers with full compliance and support? Contact Futurelink Group for a free, personalised consultation. Call us on +44 (0) 1923 277900 or email sales@futurelinkgroup.co.uk.

Frequently Asked Questions About Umbrella Companies for Engineers

Engineers considering umbrella options often seek clarity on myths, benefits, and compliance. Below, we address common questions based on current UK regulations and practical experience.

Yes, as an umbrella employee, IR35 compliance is being met fully, eliminating determination risks and personal liability.

Joint and several liability makes agencies and clients responsible for unpaid PAYE if an umbrella fails, emphasising the need for fully compliant providers.

Compliant umbrellas follow HMRC rules for deductions; fees vary slightly but cover payroll, compliance, and benefits transparently.

Look for public liability, employers’ liability, personal accident, and professional indemnity to cover engineering-specific risks.

Yes, tax-deductible expenses like site-to-site travel and overnight accommodation can be submitted to mitigate taxes, thereby increasing take-home pay.

We provide compliant PAYE processing, daily payrolls, statutory benefits, comprehensive insurances, and dedicated support tailored for engineering contractors.

Craig Moss

Craig Moss is a seasoned professional in the employment and recruitment industries, based in Kings Langley, UK. With over 30 years of experience, including a successful tenure as a central London realtor handling properties up to £3 million, he now leads an exciting management role at Futurelink Group. Specialising in compliant payroll solutions for contract recruitment, Craig helps clients increase margins by up to 30% while navigating complex legislation. His people-focused approach, honed through decades in sales and people management, ensures both recruiters and workers benefit from tax-efficient, compliant solutions. Passionate about building strong relationships, Craig thrives on delivering results that drive business success.