Did you know that HMRC penalties for non-compliance for maritime projects can reach up to £3,000 per month, potentially crippling operations in the high-stakes energy sector?

This stark warning from industry regulators highlights the critical need for robust compliance strategies to avoid costly pitfalls.

Key Areas We Will Cover

- Understanding the Construction Industry Scheme and its scope

- How CIS applies specifically to oil, gas, and renewable energy projects

- Registration and verification processes for contractors and subcontractors

- Managing tax deductions, payments, and monthly returns

- Common exemptions, penalties, and risk mitigation strategies

- Tailored payroll and compliance solutions from Futurelink Group

- Navigating international and offshore considerations

Introduction

The UK’s Construction Industry Scheme, commonly known as CIS, plays a pivotal role in regulating tax deductions for contractors and subcontractors in the construction sector, including those operating in oil, gas and renewables. With evolving HMRC guidelines and the unique challenges of offshore and onshore projects, ensuring CIS compliance is essential to minimise financial risks, maintain cash flow, and focus on core operations. This comprehensive guide draws on official HMRC resources and industry insights to provide practical advice for UK contractors, helping you navigate deductions, verifications, and more while highlighting how expert support can streamline the process.

What is the Construction Industry Scheme?

The CIS is an HMRC initiative designed to combat tax evasion in the construction industry by requiring contractors to deduct tax at source from payments to subcontractors. Introduced under the Finance Act 2004, it applies to a wide range of construction operations, ensuring that taxes are collected efficiently.

Key Definitions Under CIS

- Contractors: Businesses or individuals who pay subcontractors for construction work, including mainstream contractors and deemed contractors like oil companies, spending over £3 million annually on construction.

- Subcontractors: Those performing construction work for contractors, who may receive payments gross or with deductions.

- Construction Operations: Includes building, alterations, repairs, demolition, site preparation, and installations for systems like heating, power supply, and pipelines.

Short paragraphs ensure clarity: CIS does not apply to employees or private householders, focusing instead on self-employed workers and businesses.

Does CIS Apply to Oil, Gas, and Energy Projects?

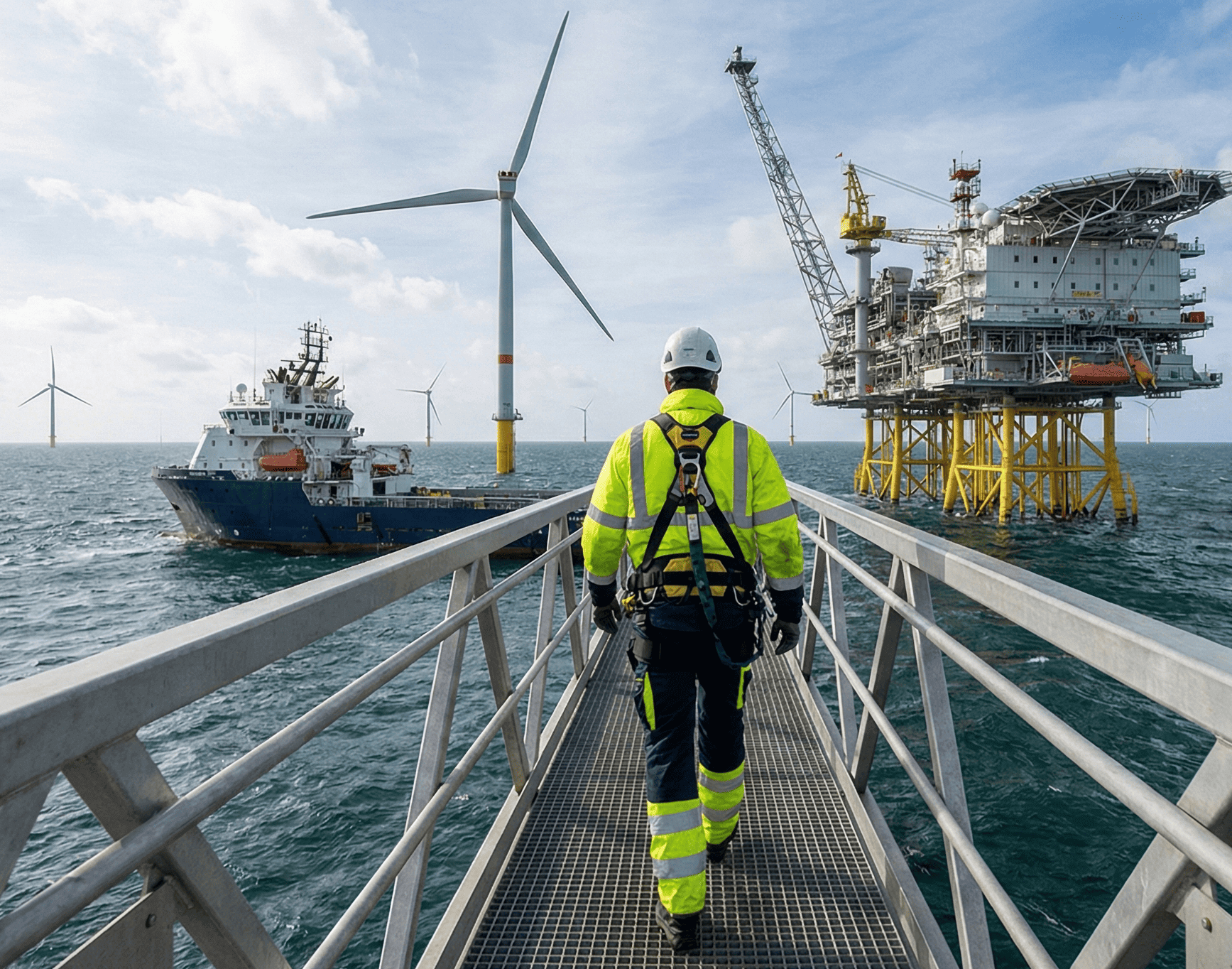

Yes, but with nuances. CIS covers construction-related activities in the oil, gas, and energy sectors within the UK and its territorial waters up to 12 nautical miles. This includes pipelaying, building offshore platforms, wind farm installations, dredging, and civil engineering works.

Included Activities

- Construction and repair of industrial plants, power lines, and gas mains.

- Installations for underwater exploration or exploitation of resources.

- Site clearance, excavation, and foundations for energy projects.

However, core extraction activities are exempt:

- Drilling for or extracting oil or natural gas.

- Mineral extraction by underground or surface methods.

For renewable energy, such as offshore wind farms, CIS applies to construction in UK waters, but not to pure manufacturing or delivery of components. Competitors like RSM UK emphasise that overseas businesses must comply if work is in UK territories, avoiding double taxation risks.

Onshore vs Offshore Considerations

Onshore projects like gas pipelines fall fully under CIS. Offshore, non-resident contractors must report income from UK territorial seas, with verifications required for correct tax treatment. HMRC treats installations like oil wells as permanent establishments, triggering CIS obligations.

Registration and Verification Processes

All contractors must register with HMRC before starting work, using the online CIS portal or by post if needed. Subcontractors should register to avoid the higher 30% deductions.

Steps for Verification

- Obtain the subcontractor’s Unique Taxpayer Reference (UTR).

- Verify status via HMRC’s online service or phone helpline.

- Determine deduction rate: 0% for gross payment status, 20% for registered, or 30% for unregistered.

Industry guides, such as those from the GOV.UK and Tolley stress documenting verifications to defend against audits. For oil and gas, where supply chains involve international workers, early verification prevents payment delays.

Managing Tax Deductions and Subcontractor Payments

Deductions are calculated on labour costs, excluding materials and VAT. Contractors must provide payment statements to subcontractors within 14 days.

Deduction Rates and Processes

- Gross Payment: For subcontractors with a strong compliance history, no deductions apply.

- Standard Deduction: 20% for verified subcontractors.

- Higher Rate: 30% for those unverified or unregistered.

In energy sectors, accurate tracking is crucial for complex projects. Use electronic systems for computations, and ensure that payslips detail deductions clearly. Automation, as recommended in checklists from SHMS Contracting, reduces errors and supports audits.

Monthly Returns and HMRC Payments

Submit CIS300 returns by the 19th of each month, detailing payments and deductions. Late filings incur penalties starting at £100, escalating to £3,000 for repeated issues.

Common Exemptions, Penalties, and Risk Mitigation

Exemptions include professional services like engineering consultations, artistic works, and equipment hire without operators. In oil and gas, extraction itself is exempt, but related construction is not.

Avoiding Penalties

- Maintain records for six years.

- Conduct worker status checks using HMRC’s CEST tool.

- Monitor IR35 status, especially post-April 2021 reforms for medium/large firms.

Non-compliance risks fines, interest, and reputational damage. Guides from UK Property Accountants note that thorough due diligence, like clear contracts and regular HMRC updates, mitigates these.

How Futurelink Group Supports CIS Compliance

With 30 years of expertise, Futurelink Group offers tailored payroll solutions for oil, gas, and energy contractors, ensuring full HMRC adherence.

Our Services

- CIS Self-Employed Option: 20% tax deduction, tax-efficient for independent workers.

- CIS PAYE and PAYE Plus: Includes benefits like pensions, with expense claims to maximise take-home pay.

- Accountancy support for tax planning, VAT returns, and international payroll.

Clients benefit from quick payments, expert consultations, and reduced administrative burdens, aligning with best practices from competitors.

Navigating International and Offshore Payroll

For cross-border projects, comply with both UK and international rules. Futurelink bridges this with custom solutions, handling residency verifications and excluding travel costs from National Insurance where applicable.

Conclusion

In summary, CIS compliance in oil, gas, and energy demands a precise understanding of scope, deductions, and verifications to avoid penalties and optimise operations. By focusing on accurate records, worker status checks, and timely submissions, contractors can thrive in this dynamic sector. Leveraging expert support ensures efficiency and peace of mind.

Ready to Achieve Seamless CIS Compliance?

Partner with Futurelink Group today for personalised payroll and compliance solutions tailored to your oil, gas, and energy needs. Contact us for a free consultation and discover how we can reduce your risks while boosting profitability.

Frequently Asked Questions

Have questions about CIS in the oil, gas, and energy sectors? This section addresses common queries based on HMRC guidelines and industry practices to provide clear, actionable insights.

No, it applies to construction-related activities like pipelaying and installations, but excludes drilling and extraction of oil or gas.

Register online via HMRC’s CIS portal, providing business details. It’s mandatory before making payments to subcontractors.

Penalties start at £100 for the first month, increasing to £200 for two months, and up to £3,000 or more for persistent delays.

Yes, if work is in the UK or territorial waters, verify their status and apply appropriate deductions.

We provide expert payroll options, verifications, and accountancy services to ensure full compliance and maximise efficiency for your projects.

Craig Moss

Craig Moss is a seasoned professional in the employment and recruitment industries, based in Kings Langley, UK. With over 30 years of experience, including a successful tenure as a central London realtor handling properties up to £3 million, he now leads an exciting management role at Futurelink Group. Specialising in compliant payroll solutions for contract recruitment, Craig helps clients increase margins by up to 30% while navigating complex legislation. His people-focused approach, honed through decades in sales and people management, ensures both recruiters and workers benefit from tax-efficient, compliant solutions. Passionate about building strong relationships, Craig thrives on delivering results that drive business success.